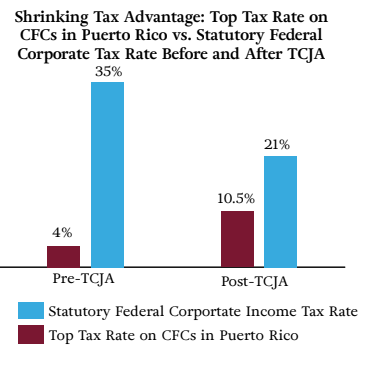

Puerto Rico's Challenges Present an Opportunity for Tax Reform - Foundation - National Taxpayers Union

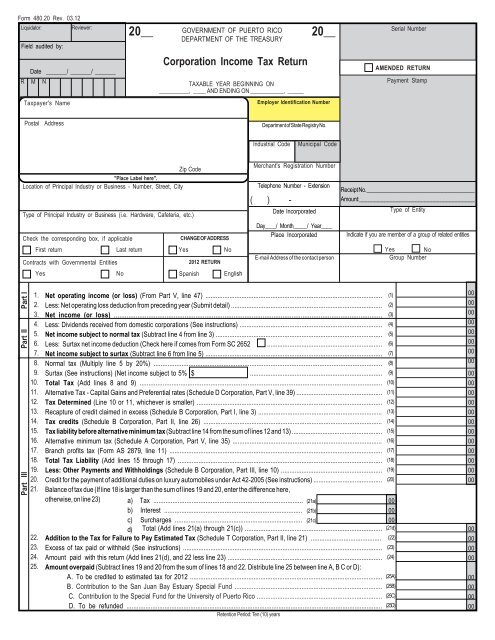

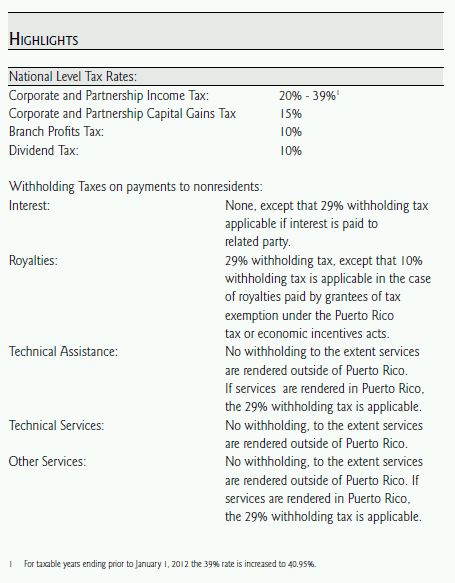

An Overview of Main Corporate Taxes in Selected Jurisdictions - Puerto Rico - Corporate Tax - Puerto Rico

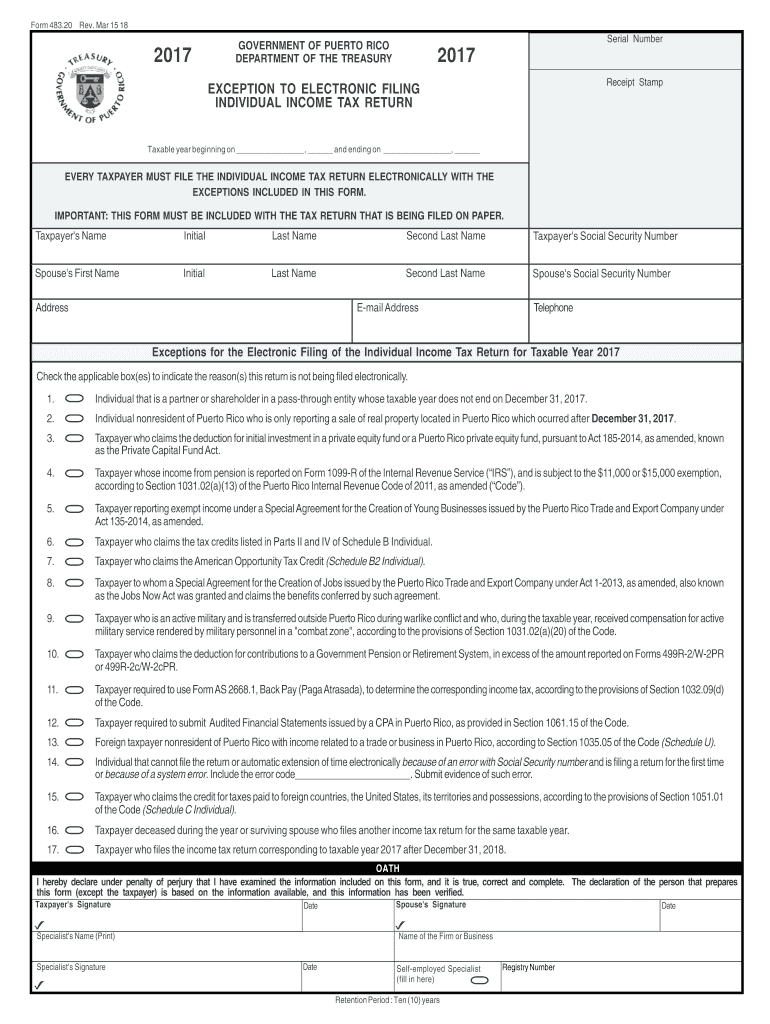

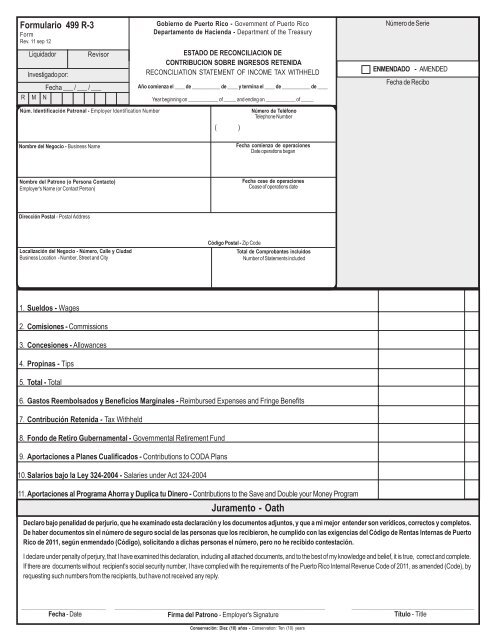

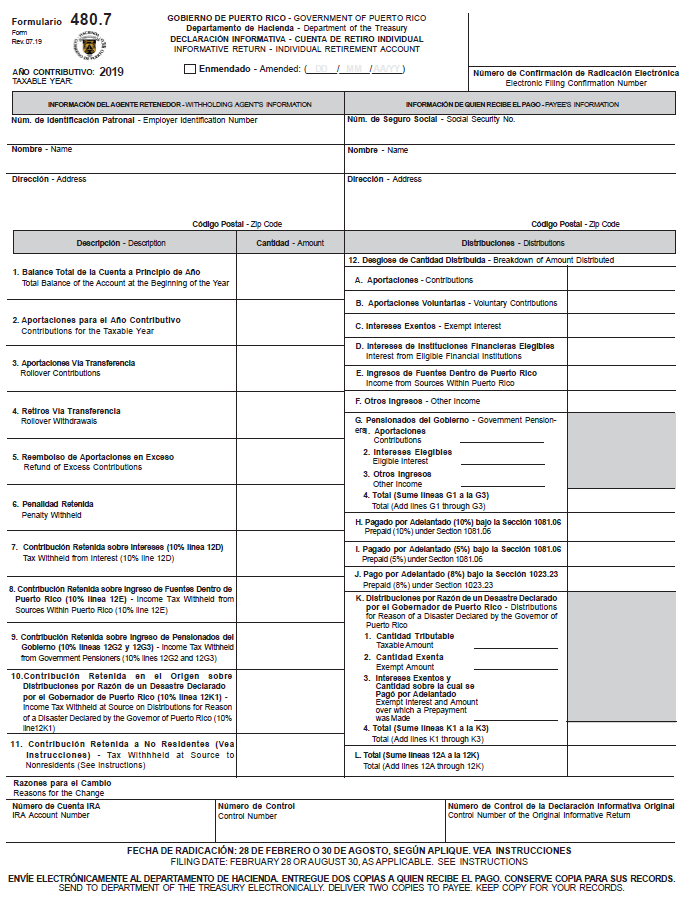

Puerto Rico Extends Due Dates for Retirement Plan Tax Reporting and Withholding Obligations Due to COVID-19 - Ogletree Deakins

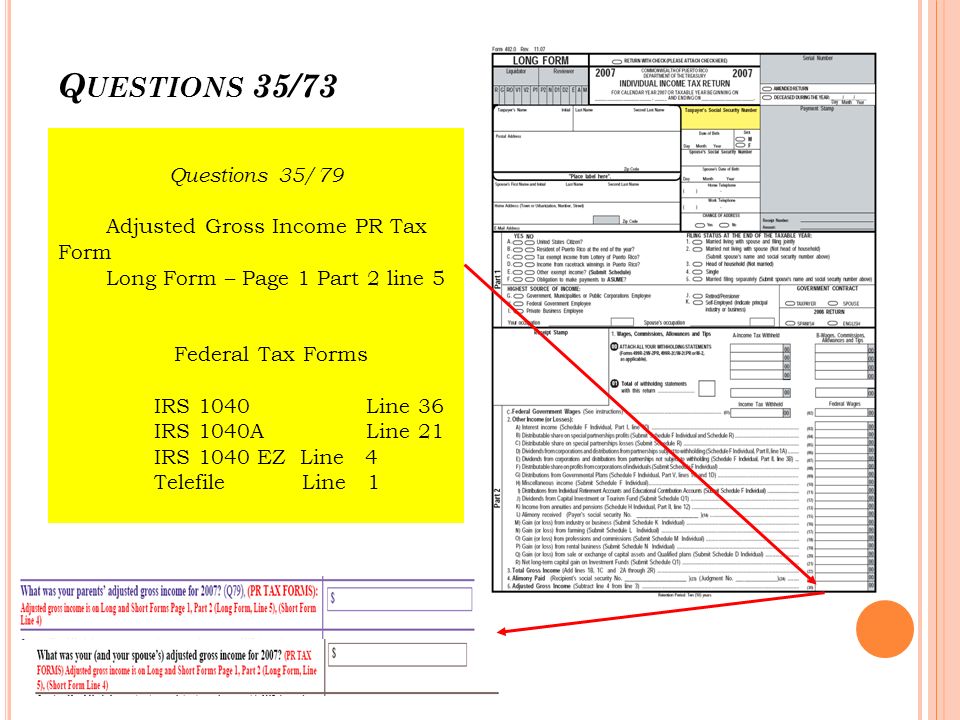

Puerto Rico's Challenges Present an Opportunity for Tax Reform - Foundation - National Taxpayers Union